All Categories

Featured

Table of Contents

If you are a non-spousal beneficiary, you have the choice to place the money you acquired into an inherited annuity from MassMutual Ascend! Acquired annuities may provide a method for you to spread out your tax obligation liability, while allowing your inheritance to continue growing.

Your decision can have tax or various other effects that you may not have actually considered. To assist stay clear of shocks, we recommend talking with a tax obligation expert or a monetary specialist before you choose.

Taxes on inherited Structured Annuities payouts

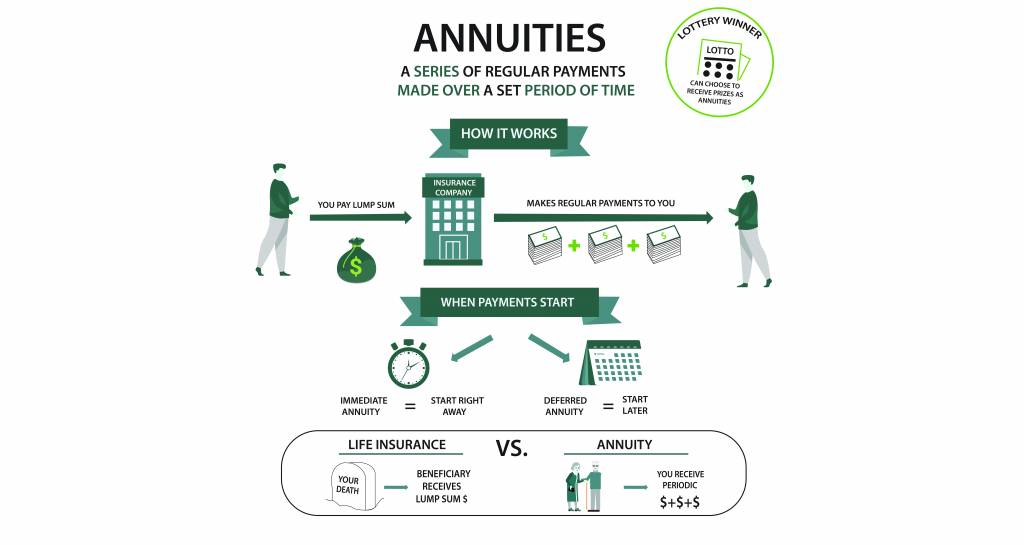

Annuities do not constantly adhere to the same rules as various other possessions. Lots of people transform to annuities to make the most of their tax benefits, as well as their special capacity to help hedge against the monetary threat of outliving your money. When an annuity proprietor passes away without ever before having actually annuitized his or her plan to pay regular revenue, the person named as beneficiary has some key choices to make.

Let's look a lot more closely at how much you have to pay in tax obligations on an inherited annuity. For a lot of kinds of home, revenue tax obligations on an inheritance are fairly easy. The common instance includes possessions that are qualified of what's referred to as a boost in tax obligation basis to the date-of-death worth of the acquired residential property, which effectively removes any type of built-in resources gains tax obligation, and offers the beneficiary a fresh start against which to determine future revenues or losses.

Taxation of inherited Period Certain Annuities

For annuities, the trick to taxation is just how much the deceased individual paid to acquire the annuity agreement, and just how much cash the dead individual obtained from the annuity before death. IRS Publication 575 says that, in basic, those acquiring annuities pay tax obligations the same method that the original annuity proprietor would certainly.

In that case, the tax is much less complex. You'll pay tax obligation on whatever over the price that the original annuity owner paid. The quantity that represents the initial costs repayment is dealt with as tax obligation basis, and consequently omitted from gross income. There is an unique exemption for those who are qualified to get guaranteed repayments under an annuity agreement. Flexible premium annuities.

Over that quantity, payouts are taxed. This reverses the common policy, and can be a big benefit for those acquiring an annuity. Acquiring an annuity can be a lot more difficult than getting various other home as a beneficiary. By knowing unique guidelines, though, you can pick the least-taxed choices readily available in taking the cash that's been entrusted to you.

We 'd like to hear your questions, ideas, and viewpoints on the Knowledge Center as a whole or this web page specifically. Your input will certainly assist us aid the globe spend, much better! Email us at. Many thanks-- and Mislead on!.

Tax implications of inheriting a Joint And Survivor Annuities

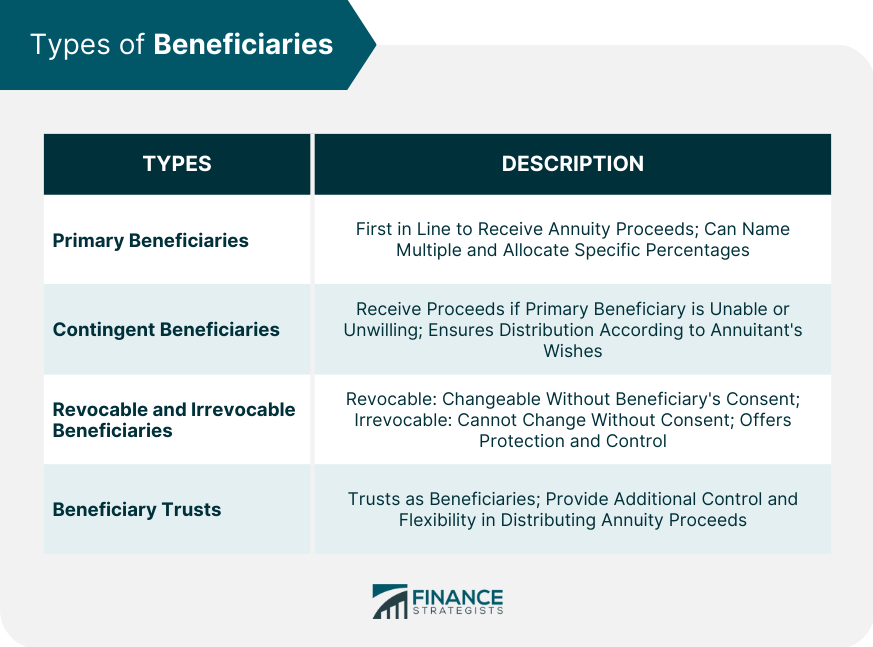

When an annuity proprietor dies, the continuing to be annuity worth is paid to people that have actually been named as beneficiaries. Annuity rates. The death benefit can produce a financial windfall for beneficiaries, yet it will certainly have different tax ramifications relying on the kind of annuity and your recipient status. The tax obligation you pay on annuity fatality benefits depends on whether you have actually a certified or non-qualified annuity.

If you have a non-qualified annuity, you will not pay earnings taxes on the contributions portion of the circulations because they have currently been taxed; you will only pay revenue taxes on the profits part of the circulation. An annuity death advantage is a kind of settlement made to an individual recognized as a recipient in an annuity contract, normally paid after the annuitant passes away.

The recipient can be a child, partner, moms and dad, and so on. The amount of fatality benefit payable to a beneficiary might be the amount of the annuity or the quantity left in the annuity at the time of the annuity owner's death. If the annuitant had begun obtaining annuity settlements, these settlements and any type of relevant fees are deducted from the death proceeds.

In this instance, the annuity would provide an ensured survivor benefit to the recipient, no matter the staying annuity equilibrium. Annuity fatality benefits undergo earnings tax obligations, yet the tax obligations you pay depend on exactly how the annuity was fundedQualified and non-qualified annuities have various tax obligation effects. Qualified annuities are funded with pre-tax money, and this indicates the annuity owner has not paid taxes on the annuity payments.

Non-qualified annuities are funded with after-tax bucks, significances the contributions have actually currently been tired, and the cash won't be subject to earnings tax obligations when distributed. Any type of revenues on the annuity payments grow tax-deferred, and you will certainly pay income taxes on the revenues part of the circulations.

Are Single Premium Annuities taxable when inherited

They can select to annuitize the contract and receive routine repayments gradually or for the remainder of their life or take a round figure payment. Each settlement choice has various tax obligation ramifications; a lump sum payment has the greatest tax obligation repercussions given that the settlement can push you to a greater revenue tax brace.

You can additionally utilize the 5-year regulation, which lets you spread the acquired annuity repayments over five years; you will pay tax obligations on the circulations you get annually. Beneficiaries acquiring an annuity have a number of alternatives to obtain annuity payments after the annuity owner's fatality. They include: The beneficiary can choose to receive the staying value of the annuity agreement in a solitary round figure settlement.

This option makes use of the recipient's life span to establish the size of the annuity settlements. This guideline requires recipients to take out annuity settlements within five years. They can take multiple repayments over the five-year period or as a solitary lump-sum repayment, as long as they take the full withdrawal by the 5th anniversary of the annuity proprietor's death.

Here are things you can do: As a surviving spouse or a deceased annuitant, you can take ownership of the annuity and proceed appreciating the tax-deferred status of an inherited annuity. This permits you to stay clear of paying taxes if you maintain the cash in the annuity, and you will just owe income taxes if you receive annuity repayments.

You can trade a qualified annuity for an additional certified annuity with far better attributes. You can not trade a qualified annuity for a non-qualified annuity. This benefit is a bonus that will certainly be paid to your recipients when they inherit the staying balance in your annuity.

Table of Contents

Latest Posts

Breaking Down What Is A Variable Annuity Vs A Fixed Annuity Key Insights on Your Financial Future Defining the Right Financial Strategy Benefits of Choosing the Right Financial Plan Why Tax Benefits O

Highlighting the Key Features of Long-Term Investments Everything You Need to Know About Variable Vs Fixed Annuities Defining Fixed Vs Variable Annuity Pros And Cons Advantages and Disadvantages of Di

Breaking Down Annuity Fixed Vs Variable Everything You Need to Know About Financial Strategies Breaking Down the Basics of Investment Plans Benefits of Fixed Vs Variable Annuity Pros Cons Why Choosing

More

Latest Posts