All Categories

Featured

Two individuals acquisition joint annuities, which offer a guaranteed earnings stream for the remainder of their lives. When an annuitant dies, the rate of interest earned on the annuity is taken care of in different ways depending on the type of annuity. A kind of annuity that stops all settlements upon the annuitant's fatality is a life-only annuity.

The initial principal(the quantity initially transferred by the moms and dads )has currently been tired, so it's not subject to tax obligations once more upon inheritance. However, the earnings section of the annuity the interest or investment gains accumulated in time goes through earnings tax. Normally, non-qualified annuities do.

have actually passed away, the annuity's benefits commonly revert to the annuity owner's estate. An annuity owner is not lawfully required to inform existing beneficiaries concerning modifications to recipient designations. The decision to alter beneficiaries is usually at the annuity owner's discernment and can be made without notifying the existing recipients. Given that an estate technically does not exist until a person has died, this recipient classification would only come right into impact upon the fatality of the named person. Usually, when an annuity's proprietor dies, the assigned beneficiary at the time of fatality is qualified to the benefits. The partner can not transform the beneficiary after the owner's death, also if the recipient is a small. Nevertheless, there may be particular stipulations for managing the funds for a small recipient. This typically entails designating a guardian or trustee to manage the funds until the child maturates. Usually, no, as the beneficiaries are not liable for your financial debts. It is best to consult a tax obligation expert for a certain answer relevant to your case. You will proceed to get repayments according to the agreement schedule, yet trying to obtain a round figure or finance is likely not a choice. Yes, in mostly all instances, annuities can be inherited. The exception is if an annuity is structured with a life-only payout alternative via annuitization. This sort of payout discontinues upon the fatality of the annuitant and does not provide any type of recurring value to successors. Yes, life insurance policy annuities are generally taxed

When taken out, the annuity's earnings are strained as common earnings. The major quantity (the first investment)is not taxed. If a beneficiary is not named for annuity benefits, the annuity continues usually most likely to the annuitant's estate. The distribution will adhere to the probate process, which can postpone repayments and might have tax implications. Yes, you can call a count on as the recipient of an annuity.

Do beneficiaries pay taxes on inherited Multi-year Guaranteed Annuities

This can provide higher control over exactly how the annuity benefits are distributed and can be part of an estate preparation technique to take care of and shield properties. Shawn Plummer, CRPC Retirement Organizer and Insurance Policy Agent Shawn Plummer is an accredited Retirement Planner (CRPC), insurance agent, and annuity broker with over 15 years of firsthand experience in annuities and insurance. Shawn is the founder of The Annuity Specialist, an independent on-line insurance policy

firm servicing consumers across the United States. With this system, he and his team goal to get rid of the guesswork in retired life preparation by helping individuals discover the best insurance policy coverage at one of the most competitive prices. Scroll to Top. I understand every one of that. What I don't understand is how previously entering the 1099-R I was revealing a reimbursement. After entering it, I currently owe tax obligations. It's a$10,070 difference in between the refund I was expecting and the taxes I now owe. That appears extremely severe. At a lot of, I would certainly have expected the reimbursement to minimize- not entirely go away. A financial expert can assist you decide exactly how finest to take care of an inherited annuity. What takes place to an annuity after the annuity owner passes away relies on the terms of the annuity contract. Some annuities merely stop distributing revenue repayments when the proprietor dies. In a lot of cases, however, the annuity has a death advantage. The recipient might receive all the continuing to be cash in the annuity or a guaranteed minimum payment, normally whichever is better. If your parent had an annuity, their contract will certainly specify who the recipient is and may

right into a pension. An acquired IRA is a special pension made use of to disperse the properties of a dead individual to their beneficiaries. The account is signed up in the departed person's name, and as a beneficiary, you are incapable to make extra contributions or roll the inherited IRA over to an additional account. Just certified annuities can be rolledover into an inherited IRA.

Latest Posts

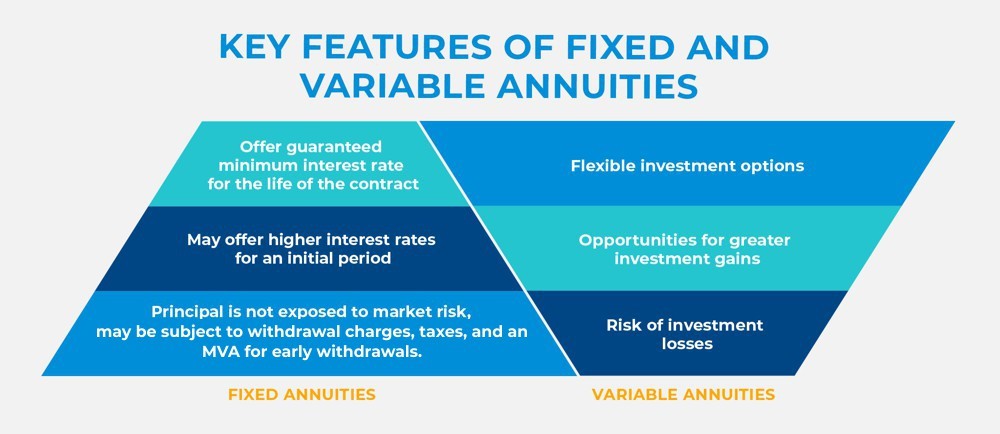

Breaking Down What Is A Variable Annuity Vs A Fixed Annuity Key Insights on Your Financial Future Defining the Right Financial Strategy Benefits of Choosing the Right Financial Plan Why Tax Benefits O

Highlighting the Key Features of Long-Term Investments Everything You Need to Know About Variable Vs Fixed Annuities Defining Fixed Vs Variable Annuity Pros And Cons Advantages and Disadvantages of Di

Breaking Down Annuity Fixed Vs Variable Everything You Need to Know About Financial Strategies Breaking Down the Basics of Investment Plans Benefits of Fixed Vs Variable Annuity Pros Cons Why Choosing

More

Latest Posts