All Categories

Featured

Table of Contents

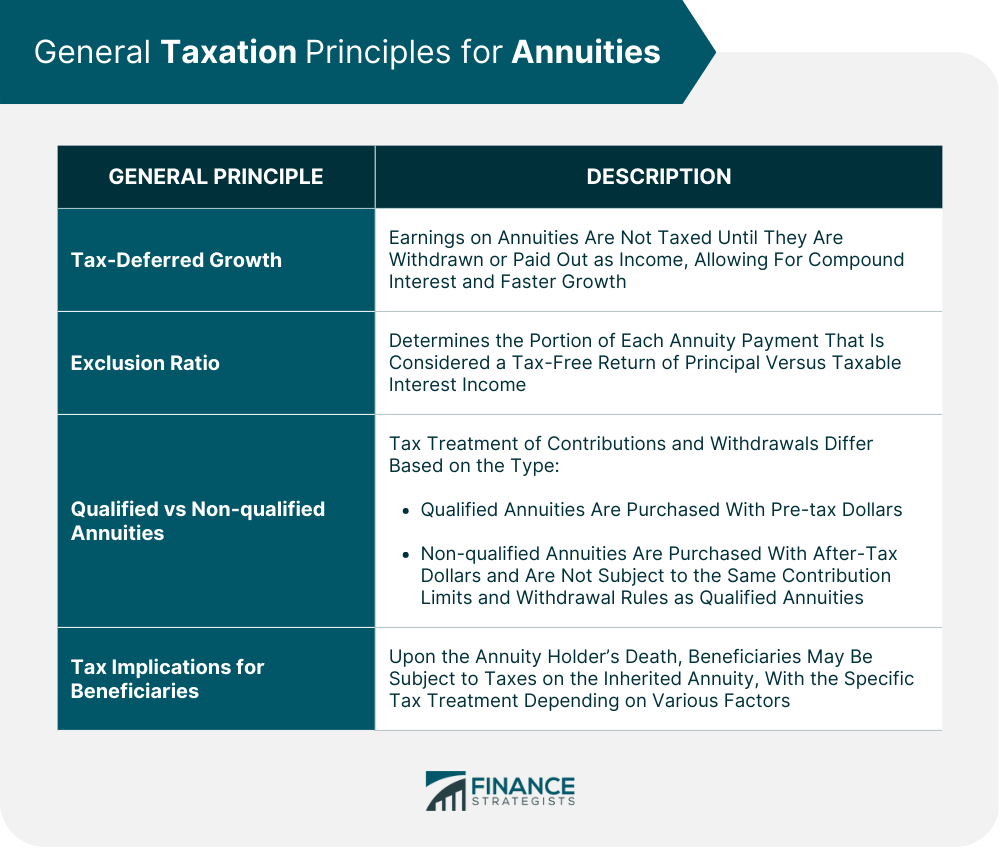

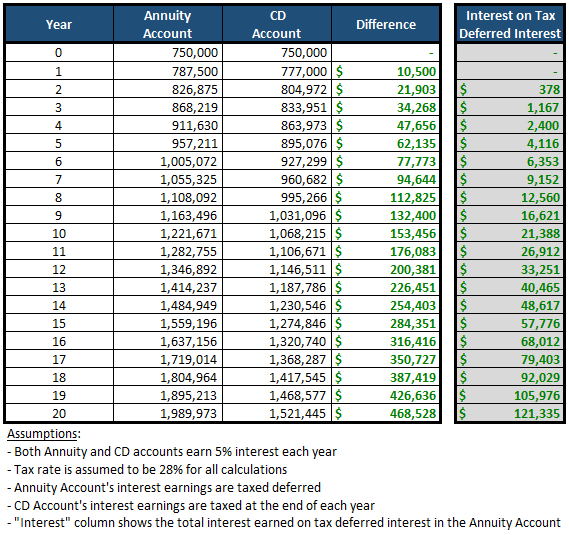

When you gain passion in an annuity, you commonly don't need to report those profits and pay earnings tax obligation on the profits every year. Development in your annuity is insulated from personal revenue tax obligations.

While this is an introduction of annuity taxation, get in touch with a tax expert before you make any decisions. Index-linked annuities. When you have an annuity, there are a number of details that can influence the tax of withdrawals and income repayments you receive. If you place pre-tax money into a specific retired life account (IRA) or 401(k), you pay taxes on withdrawals, and this holds true if you money an annuity with pre-tax money

If you contend the very least $10,000 of earnings in your annuity, the entire $10,000 is treated as earnings, and would usually be taxed as common revenue. After you wear down the profits in your account, you get a tax-free return of your initial swelling amount. If you convert your funds right into a guaranteed stream of income settlements by annuitizing, those repayments are split into taxed portions and tax-free parts.

Each repayment returns a section of the cash that has actually already been tired and a portion of passion, which is taxed. For instance, if you obtain $1,000 each month, $800 of each settlement may be tax-free, while the remaining $200 is taxable income. Eventually, if you outlive your statistically established life expectancy, the whole quantity of each payment might become taxable.

Since the annuity would have been funded with after-tax money, you would not owe tax obligations on this when withdrawn. In basic, you must wait till at the very least age 59 1/2 to withdraw profits from your account, and your Roth has to be open for at the very least 5 years.

Still, the other attributes of an annuity might surpass income tax obligation therapy. Annuities can be devices for deferring and managing taxes. Assess just how ideal to structure your retired life, charitable giving and various other financial objectives with the assistance of a monetary professional and tax obligation expert. A tax-aware method might help you make use of annuity benefits and avoid surprises later on.

How is an inherited Annuity Payouts taxed

If there are any penalties for underreporting the earnings, you may be able to ask for a waiver of penalties, yet the rate of interest usually can not be waived. You may be able to organize a repayment strategy with the IRS (Fixed annuities). As Critter-3 stated, a local specialist may be able to help with this, yet that would likely result in a little bit of added cost

The initial annuity contract holder have to consist of a death benefit provision and call a recipient. Annuity recipients are not limited to individuals.

Fixed-Period Annuity A fixed-period, or period-certain, annuity ensures repayments to you for a details length of time. Life Annuity As the name suggests, a life annuity assurances you settlements for the rest of your life.

Is an inherited Fixed Income Annuities taxable

If your contract consists of a survivor benefit, staying annuity payments are paid to your recipient in either a round figure or a collection of repayments. You can choose someone to obtain all the readily available funds or numerous individuals to get a portion of remaining funds. You can likewise select a nonprofit company as your recipient, or a count on established as component of your estate plan.

Doing so enables you to maintain the exact same options as the initial owner, including the annuity's tax-deferred condition. Non-spouses can additionally inherit annuity payments.

There are 3 primary means beneficiaries can receive acquired annuity settlements. Lump-Sum Distribution A lump-sum distribution allows the beneficiary to get the agreement's whole continuing to be worth as a single repayment. Nonqualified-Stretch Stipulation This annuity agreement clause permits a recipient to obtain settlements for the rest of his or her life.

Any beneficiary including partners can pick to take a single lump sum payout. In this instance, taxes are owed on the whole difference in between what the initial owner paid for the annuity and the survivor benefit. The swelling sum is strained at average revenue tax obligation rates. Swelling sum payments carry the highest tax obligation concern.

Spreading settlements out over a longer amount of time is one means to avoid a huge tax bite. For instance, if you make withdrawals over a five-year duration, you will owe taxes only on the boosted value of the part that is taken out in that year. It is likewise much less most likely to press you right into a much greater tax obligation bracket.

Do you pay taxes on inherited Annuity Payouts

This provides the least tax obligation direct exposure yet additionally takes the lengthiest time to get all the cash. Annuity income riders. If you have actually acquired an annuity, you usually should make a decision regarding your death advantage quickly. Choices concerning how you desire to obtain the money are commonly final and can not be changed later on

An acquired annuity is an economic item that permits the recipient of an annuity agreement to continue receiving payments after the annuitant's death. Acquired annuities are typically used to supply revenue for enjoyed ones after the fatality of the key income producer in a family members. There are 2 sorts of inherited annuities: Immediate inherited annuities start paying right now.

What taxes are due on inherited Fixed Income Annuities

Deferred inherited annuities allow the beneficiary to wait up until a later date to start receiving repayments. The best thing to do with an acquired annuity depends on your economic scenario and requirements.

It is very important to speak to a financial advisor before making any kind of choices regarding an acquired annuity, as they can aid you determine what is finest for your specific conditions. There are a few risks to take into consideration prior to buying an acquired annuity. First, you must know that the federal government does not ensure inherited annuities like various other retired life items.

Tax treatment of inherited Lifetime Annuities

Second, acquired annuities are frequently complex financial products, making them tough to understand. There is always the danger that the worth of the annuity might go down, which would certainly minimize the quantity of money you receive in repayments.

Table of Contents

Latest Posts

Breaking Down What Is A Variable Annuity Vs A Fixed Annuity Key Insights on Your Financial Future Defining the Right Financial Strategy Benefits of Choosing the Right Financial Plan Why Tax Benefits O

Highlighting the Key Features of Long-Term Investments Everything You Need to Know About Variable Vs Fixed Annuities Defining Fixed Vs Variable Annuity Pros And Cons Advantages and Disadvantages of Di

Breaking Down Annuity Fixed Vs Variable Everything You Need to Know About Financial Strategies Breaking Down the Basics of Investment Plans Benefits of Fixed Vs Variable Annuity Pros Cons Why Choosing

More

Latest Posts